FinCEN's BOI Reporting Deadline: Bemidji, MN Businesses Must File by 01/01/2025

The Corporate Transparency Act (CTA) requires Bemidji, MN businesses to disclose Beneficial Ownership Information (BOI) to FinCEN to promote financial transparency and deter illegal activities like money laundering and tax evasion.

As of today, 11-26-2024, Bemidji business owners have 36 calendar days (or 27 business days) left to file their BOI reports with FinCEN—failure to comply could result in fines of $500 per day.

Key Steps for Compliance

1. Verify if Your Business Must File

Deadline: ASAP

Most LLCs, corporations, and similar entities are required to file unless exempt (e.g., publicly traded companies, charities).

2. Identify Beneficial Owners

Deadline: 12-10-2024

A beneficial owner is anyone who:

-

Owns at least 25% of the company, or

-

Exercises substantial control over operations.

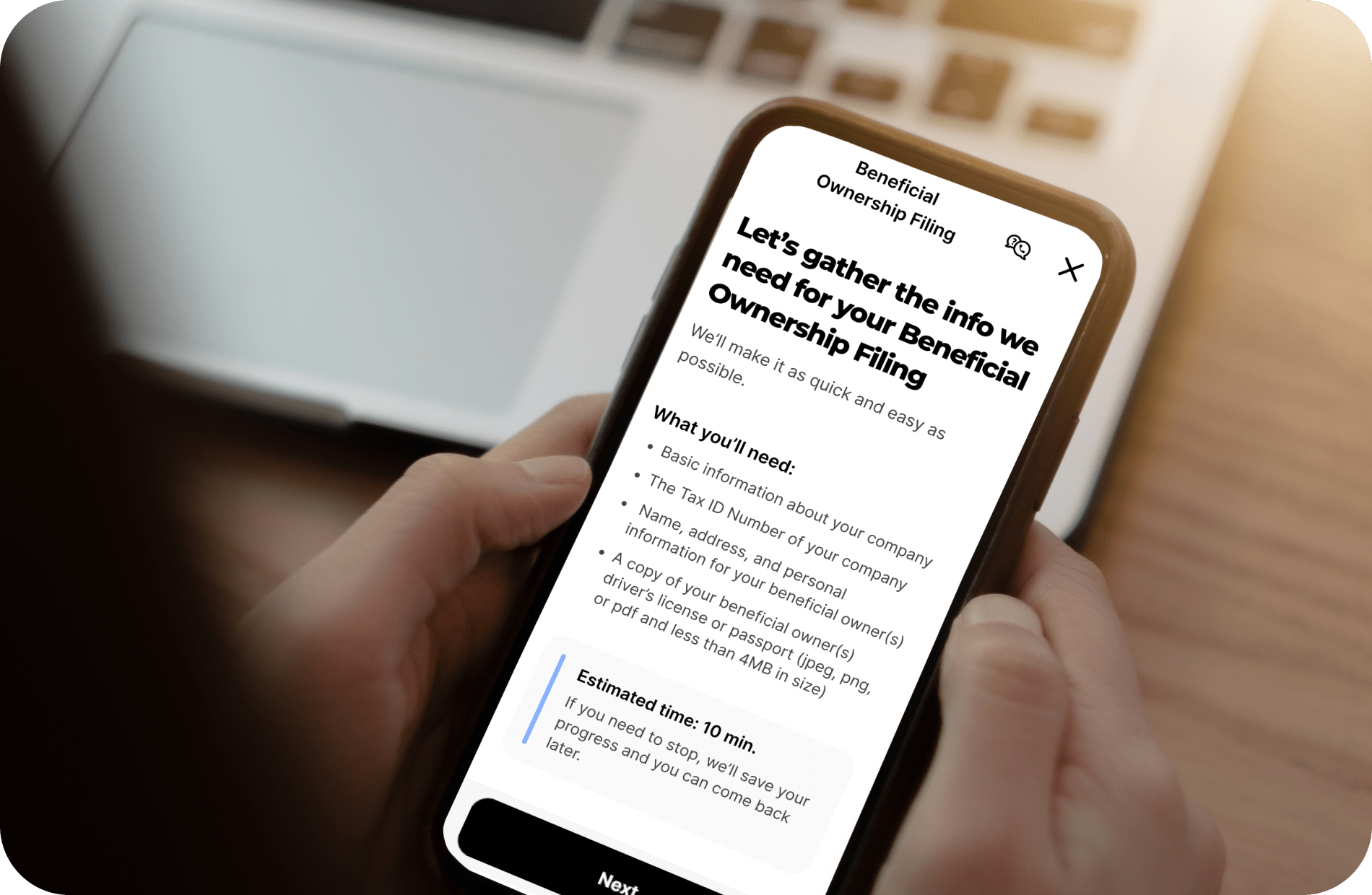

3. Collect Required Information

Deadline: 12-17-2024

You’ll need:

-

Company Info: Legal name, EIN, address.

-

Owner Details: Names, birthdates, addresses, and ID documentation.

4. Submit Your BOI Report

Deadlines:

-

Existing companies: 01/01/2025

-

New companies (2024): Within 90 days of formation

-

New companies (2025 onward): Within 30 days of formation

ZenBusiness simplifies BOI filing—get started today.

What Bemidji Businesses Need to Know

Who Needs to File?

A "reporting company" includes most U.S.-formed LLCs and corporations. Exemptions apply to charities, banks, and publicly traded firms. For example, a Bemidji-based small manufacturing company would likely need to file.

What Defines a Beneficial Owner?

Beneficial owners are individuals with:

-

Substantial control over decisions, or

-

Ownership of at least 25% of the company.

Example: A Bemidji coffee shop co-owned by three individuals, with one managing operations and owning 40%, makes that individual a beneficial owner.

What Information Must Be Submitted?

Reports require:

-

Company Details: Legal name, EIN, address.

-

Owner Information: Full names, birthdates, addresses, and official ID numbers.

How to File and Deadlines

BOI reports must be filed electronically via FinCEN’s secure portal. Filing deadlines include:

-

Existing businesses: 01/01/2025

-

New entities (2024): Within 90 days of formation

-

New entities (2025 or later): Within 30 days of formation

Non-Compliance Penalties

Failing to file can result in:

-

Daily fines of $500

-

Criminal charges for deliberate misrepresentation.

A 90-day safe harbor is available for correcting errors post-filing.

Why Choose ZenBusiness for BOI Filing?

ZenBusiness offers professional guidance to help Bemidji businesses accurately prepare and file their BOI reports. Their services save time and ensure compliance, providing peace of mind. Learn more here.

Additional BOI Filing Resources

Don’t miss the 01/01/2025 deadline—file today to avoid penalties!

Thank you to our Sponsors!

Want to sponsor Chamber News or appear in a Member Spotlight? Contact us today!